Learn More about capital one appointment

Are capital one appointment you looking for financial advice or guidance on your accounts with Capital One? Maybe you have some questions about their services and want to talk to a professional. Fortunately, making a Capital One appointment is easy and can provide the answers you need. In this blog post, we’ll explore everything you need to know about scheduling an appointment with Capital One, including why it’s important, how to do it, what to expect during your meeting, and alternatives if you prefer not to meet in person. Let’s dive into the world of financial advising together!

What is Capital One?

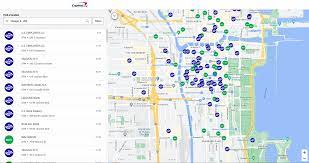

Capital One is a leading financial institution in the United States that offers a wide range of banking and credit card services. Founded in 1994, it has grown to become one of the largest banks in America with over 750 branches across the country.

One of Capital One’s most popular offerings is their credit cards, which come with competitive rewards programs and low interest rates. They also offer checking accounts, savings accounts, personal loans, mortgages and various other financial products.

What sets Capital One apart from other traditional banks is its digital-first approach. The bank has invested heavily in its mobile app and online banking platform so customers can manage their finances remotely without having to visit a branch.

Capital One prides itself on being customer-centric and strives to make managing money as easy as possible for everyone who uses their services. This dedication to innovation makes them an ideal choice for those who value convenience when dealing with finances.

Why You Might Need to Make a Capital One Appointment

There are various reasons why you might find yourself in need of making a Capital One appointment. One possible reason is if you’re interested in opening a new credit card account or personal loan with the bank. By scheduling an appointment, you’ll have the opportunity to speak directly with a representative who can explain your options and help guide you towards the best choice for your financial needs.

Another reason to make an appointment is if you’ve experienced an issue with your existing Capital One account that requires personalized attention. Whether it’s a billing error or suspicious activity on your account, meeting with someone face-to-face can be more efficient than trying to resolve the issue over the phone or online.

If you’re considering buying a home or refinancing your mortgage, setting up an appointment could also be beneficial. A Capital One representative will be able to provide information about their mortgage products and answer any questions you may have about rates, terms, and fees.

Even if there isn’t necessarily anything specific that’s prompting your visit to Capital One, scheduling an appointment can still be helpful. It’s always good practice to review and discuss your finances regularly so that you can stay on top of any potential issues before they become bigger problems down the line.

How to Make a Capital One Appointment

Making a Capital One appointment is an easy and straightforward process. You can schedule a meeting with a representative either over the phone or online.

To make an appointment over the phone, simply call the Capital One customer service line and follow the prompts to speak with someone who can assist you in scheduling your appointment. Alternatively, you can go to their website and use their online booking system.

Once you have selected your preferred method of communication, be prepared to provide some basic information such as your name, account number (if applicable), reason for requesting an appointment, and availability.

When selecting a date and time for your appointment, try to choose a time that is convenient for both yourself and the Capital One representative. It’s important to remember that if you need to cancel or reschedule your meeting, it’s best to do so as soon as possible out of respect for everyone’s time.

Making a Capital One appointment is simple and efficient – just be sure to come prepared with any questions or concerns you may have!

What to Expect When You Meet with Capital One

When you schedule an appointment with Capital One, it’s important to know what to expect. The meeting will likely take place at a local branch office or over the phone if that is your preference.

During the meeting, a representative from Capital One will sit down with you and discuss your financial goals and needs. They may ask for documentation such as pay stubs or bank statements in order to assess your current financial situation.

Once they have a good understanding of your finances, the representative can help guide you towards products and services that best fit your needs. This could include opening up a new checking account, applying for a credit card, or discussing investment options.

It’s important to come prepared with any questions or concerns you may have about banking with Capital One. The representative should be knowledgeable about all of their products and able to answer any questions you may have.

When meeting with Capital One you can expect personalized attention focused on helping you achieve your financial goals.

Alternatives to Meeting with Capital One

If you’re not interested in meeting with Capital One or prefer to explore other options, there are a few alternatives available.

Firstly, if you have questions about your account or need help resolving an issue, you can try calling Capital One’s customer service line. The team is available 24/7 and can assist with a range of inquiries.

Another option is to utilize the resources available on the Capital One website. This includes their FAQ section which provides answers to commonly asked questions and their online chat feature which allows you to connect with a representative in real-time.

If you’re looking for financial advice but don’t want to speak directly with someone from Capital One, consider utilizing third-party services such as robo-advisors or financial planners. These professionals can provide personalized recommendations based on your unique financial situation.

Keep in mind that there may be other banks or credit unions that better fit your needs than Capital One. Researching and comparing different institutions before making a decision could save you time and money in the long run.

While meeting with Capital One can be beneficial for some individuals, it’s important to remember that there are alternative options available if needed.

Conclusion

Setting up an appointment with Capital One can be a smart move if you’re looking for financial advice or have specific questions about your accounts. Whether you make the appointment online, over the phone, or in person at one of their branch locations, Capital One makes it easy to get personalized help from knowledgeable experts.

However, if you don’t have time for an appointment or prefer to manage your finances independently, there are many online tools and resources available through Capital One’s website that can help you stay on top of your money.

No matter which option you choose, remember that taking control of your finances is an important step toward achieving your long-term goals. By working with Capital One or using their tools and resources on your own, you’ll be well on your way to financial success.