What Area Is Not Protected By Most Homeowners Insurance

Homeowners What Area Is Not Protected By Most Homeowners Insurance insurance is one of the most important investments you can make. Not only does it protect your home and belongings, but it also provides financial protection in the event of an emergency. However, not every part of your home is covered by homeowners insurance. In this blog post, we’ll explore which parts of your home are not typically protected and how to correct that. By knowing which areas are unprotected, you can make sure that you have the coverage you need in case of an emergency.

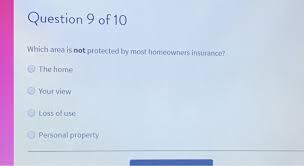

What Area Is Not Protected By Most Homeowners Insurance?

Area Not Protected By Most Homeowners Insurance

When most homeowners think of their home insurance, they typically think of the areas that are protected by their policy. These areas include inside the home, the structure itself, and any belongings that are inside of it. However, there are other areas that your policy may not cover.

One area that is not usually covered by homeowners insurance is land outside of the home. This means that if a fire breaks out in your backyard and spreads to your home, your policy likely won’t cover the damage done to your home or any possessions inside of it. Similarly, if you accidentally drive into someone else’s yard, their property will be the one that is protected by your homeowners insurance policies.

There are a few exceptions to this rule. If you live in an area where people commonly break into homes and steal things, then your home may be at greater risk than others. Additionally, if you have a pool or spa on your property, then you may be covered under homeowner’s insurance for damage done while using them.

It’s important to check with your homeowners insurance company to see whether or not any specific areas within your home are covered under their policy. Otherwise, you could wind up paying for damages that weren’t covered by your policy in the first place.

What Are Some Common Areas That Are Not Protected?

Some common areas that are not protected by most homeowners insurance policies include:

-Your home’s exterior walls

-The roof and decking of your home

-Your home’s contents, including furniture and electronics

-Structures on your property, such as a shed or garage

– adjacent land

What Are Some Tips For Protecting Your Home In These Areas?

If you live in an area that is not typically protected by homeowners insurance, there are some ways to protect your home and belongings. First, make sure you have proper insurance. If your home is not properly covered by your policy, you may be able to get coverage through the National Flood Insurance Program (NFIP). Second, put up flood protection measures like a levee or floodwall. Finally, keep a record of all damage done to your home and possessions, including receipts for any repairs made. This will help prove your case if something goes wrong in the future.

Conclusion

In this article, we are going to discuss the three main areas that most homeowners insurance does not typically cover. We will also provide some tips on how to find out if your home is covered by homeowner’s insurance and what you can do if it is not. Finally, we will give you a few examples of homes that are typically not covered by homeowner’s insurance and provide an estimate of the costs associated with repairing or replacing these structures.