Find Out All About the IFSC Codes in Detail

If you have ever been to a bank, you must have heard about the IFSC of a bank or branch. The IFSC is used for a secure online money transfer. Today there are multiple ways to use an IFSC codes finder. But why exactly did the RBI give IFSC to each bank?

Although most bank account holders know their IFSC code, most are unaware of its importance, features, and requirements in the banking system. In this blog, you will know the IFSC and IFSC code finder.

What is IFSC Code?

It is a unique code given to the bank and its separate branch for proper identification. The IFSC is an 11-digits code given to every bank that is registered under RBI. Moreover, online transfers like RTGS, IMPS, and NEFT are possible only through the IFSC code. Therefore, it is recommended to use the IFSC code finder before transferring funds for better security.

Example of IFSC Code

The 11 alphanumeric characters of the IFSC code can be broken into the following parts to understand the IFSC code finder clearly:

- The first four letters represent the bank. For example, in the Punjab National Bank IFSC code, the first 4 alphabets are PUNB.

- The fifth character is 0, irrespective of the bank name.

- The last six characters are sometimes numbers or alphanumeric, and it represents the branch code.

Salient Features of IFSc Code Finder

The IFSC code finder considers the following features of IFSC codes to provide the unique identification number for online money transfers:

- It removes any fault or error in money transfers.

- The IFSC code finder helps identify a particular branch of the bank.

- IFSC code facilitates electronic payment services such as IMPS, NEFT, and RTGS.

Why is IFSC Code Finder Necessary?

The following points elaborate on the necessity of IFSC codes and IFSC code finder to the bank account holder:

- IFSC code helps in smooth operations of the banking transactions.

- It facilitates RBI to track, maintain, and monitor electronic transactions of funds.

- Bank customers need the IFSC code of the payee to initiate an online fund transfer. In addition, the IFSC code finder can help find out the unique IFSC code of any bank account holder.

- The IFSC code finder sends electronic messages to the banks involved in the transaction to make the process secure and error-free.

What is the IFSC code finder?

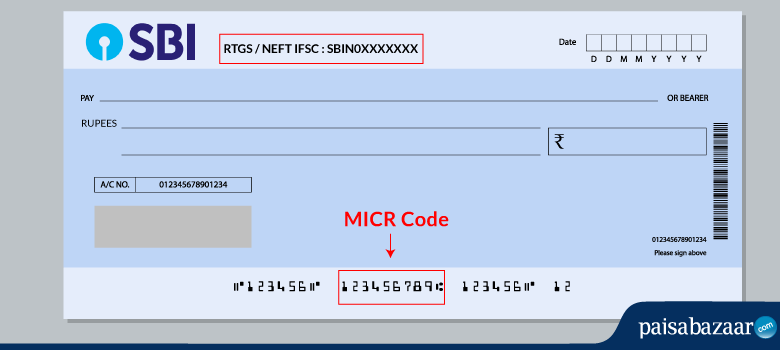

The IFSC code of a bank is printed on the cheque leaf or front page of the passbook. However, there are other methods used as IFSC code finder. They are:

- Search the official website of the Reserve Bank of India.

- Visit the official webpage of a particular bank.

- The search engine like google, bing, etc., can also act as an IFSC code finder. You can get the IFSC code of a particular branch by typing the IFSC code of (bank name <space> location of the branch).

How is MICR different from IFSC code finder?

People often get confused between IFSC code and MICR. Although both the codes are present in the chequebook, they perform different functions. The common differences between MICR and IFSC code finder are listed below:

| IFSC | MICR |

| It consists of 11 characters. | It has 9 characters. |

| The primary four characters represent the bank name. | The first three characters represent the city code. |

| It facilitates electronic money transfer. | It reduces the cheque processing time. |

Conclusion

The RBI is responsible for allotting IFSC codes to all the branches of the bank. For example, the Punjab National Bank IFSC code of 4, N.c.dutta Sarani, Kolkata is PUNB 0 008420. However, these codes cease to exist when the branch is shifted from one place to another. Therefore, to make a secure payment, you must refer to the IFSC code finder that helps in the verification and validation of the IFSC code before making a payment.